Card Manager brings together all the most popular credit and debit card management features and seamlessly presents them on a single platform. After easy download and installation, members simply register their cards on the app to enjoy many popular features, including:

Card Manager offer features that can help parents manage their teens’ debit card usage:

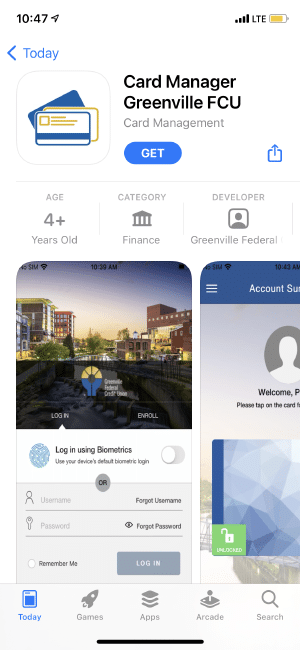

Download the free Card Manager app from the Google Play Store or the Apple App Store.

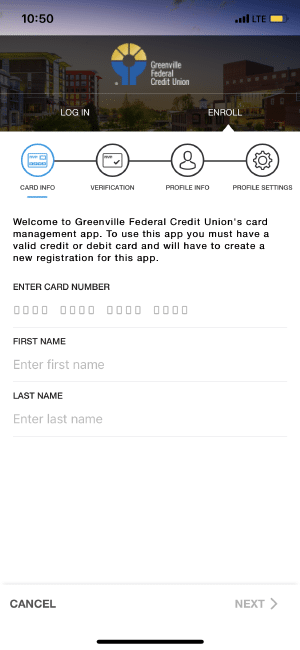

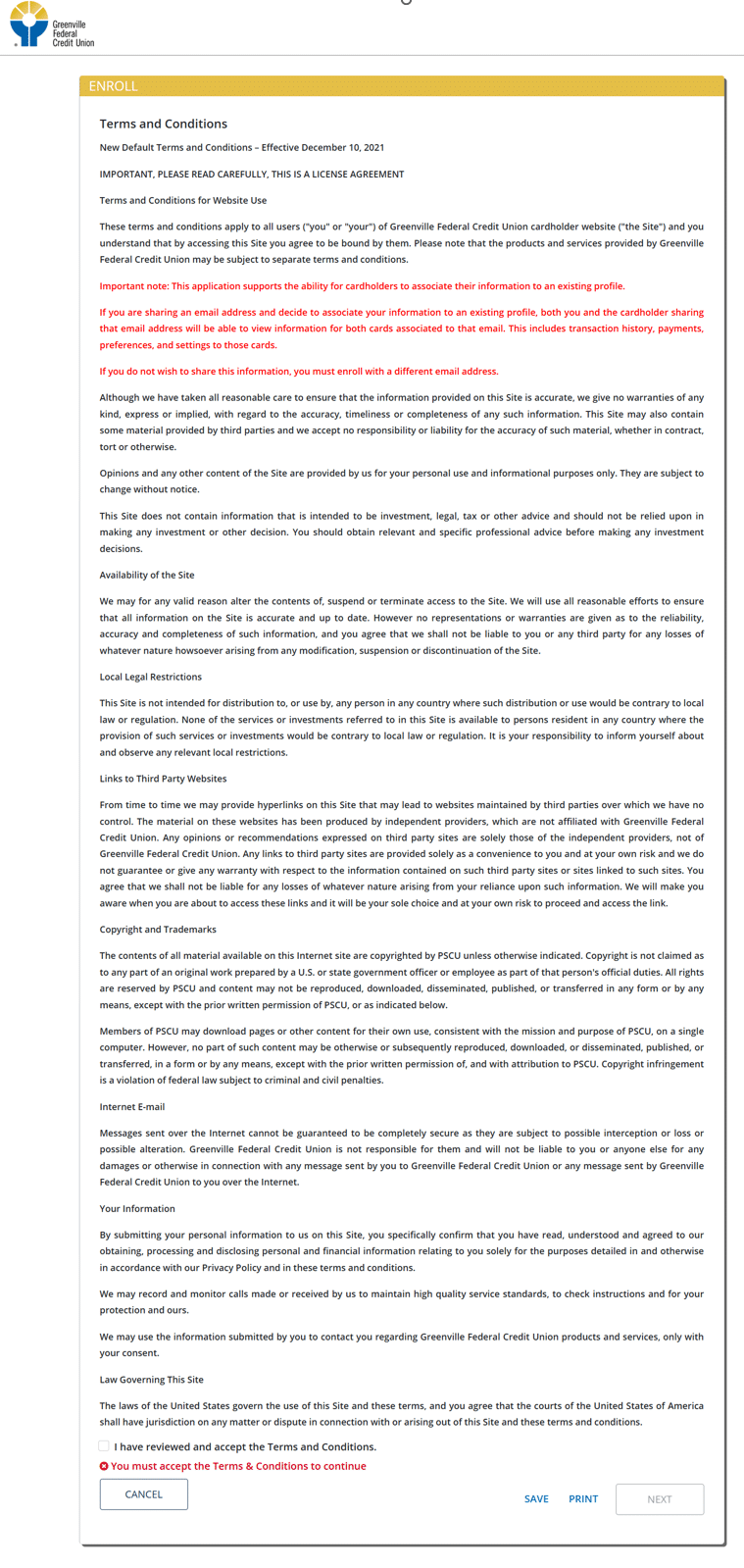

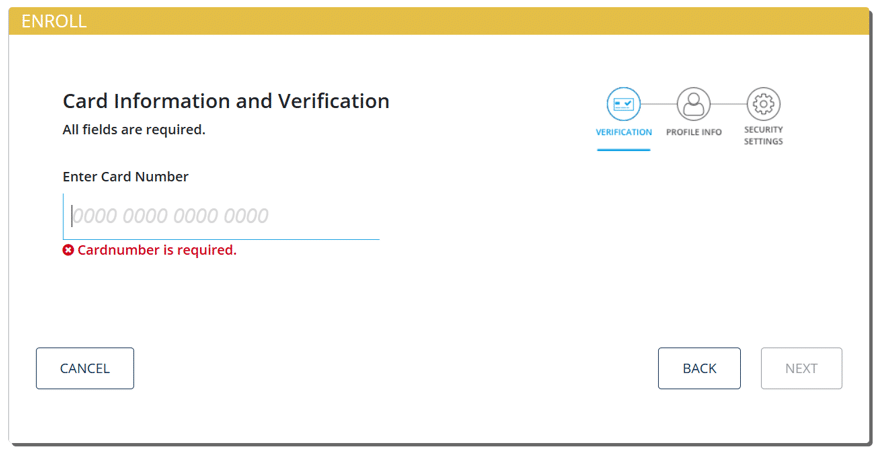

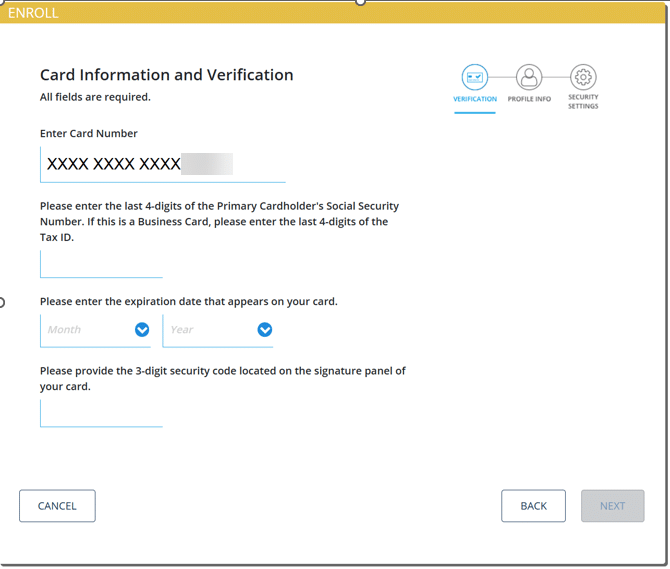

To enroll, complete the card information and verify by answering prompted questions.

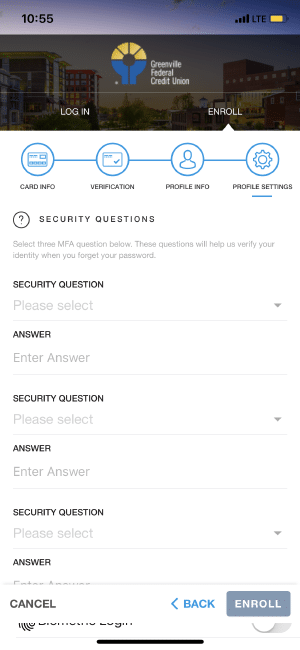

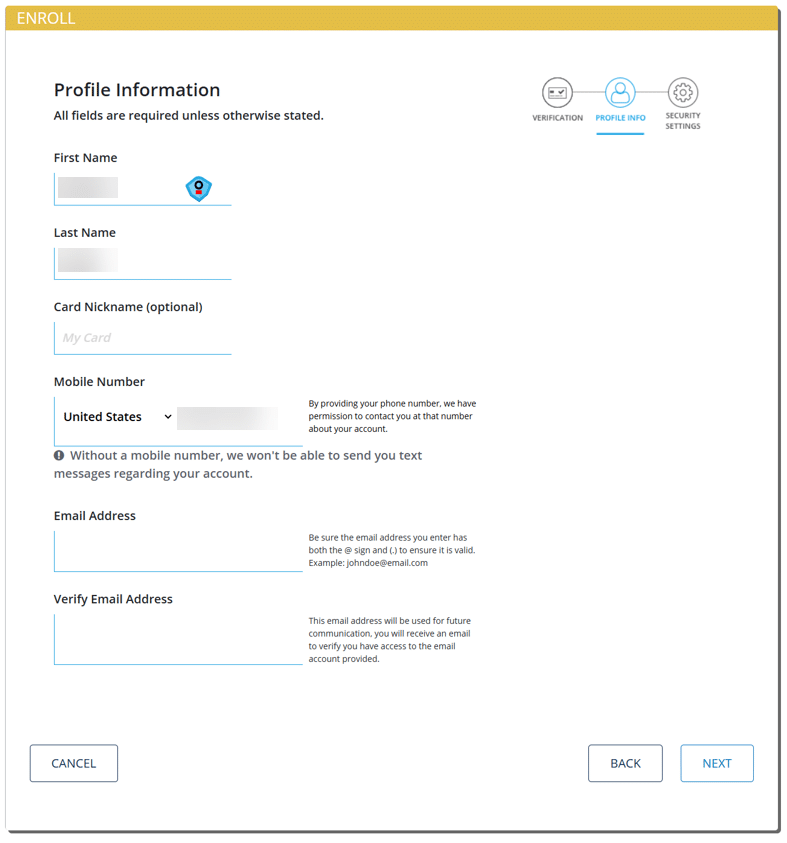

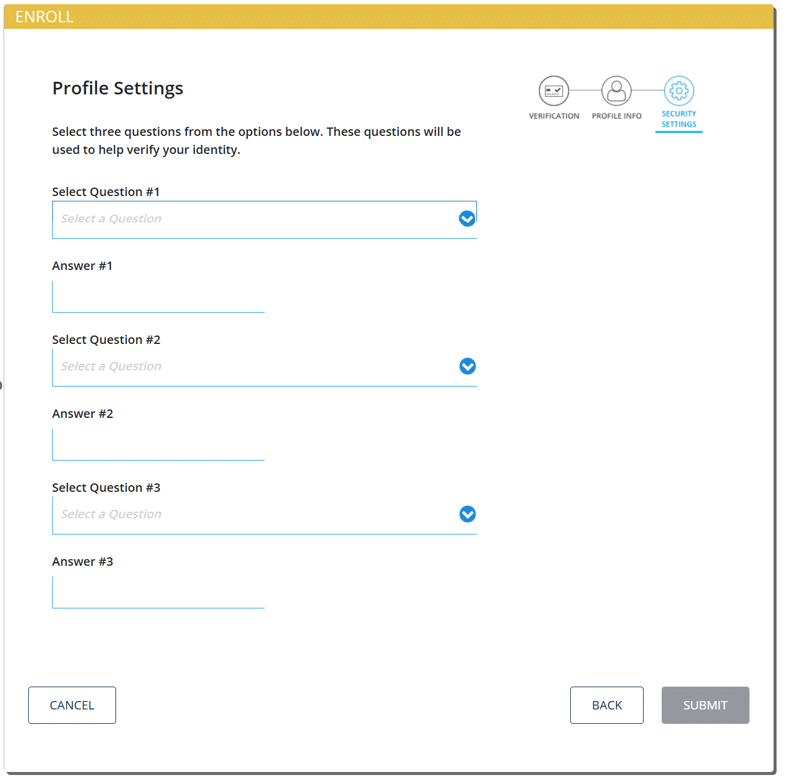

Create a User Profile. After tapping NEXT, you will be provided the opportunity to select and answer security questions.

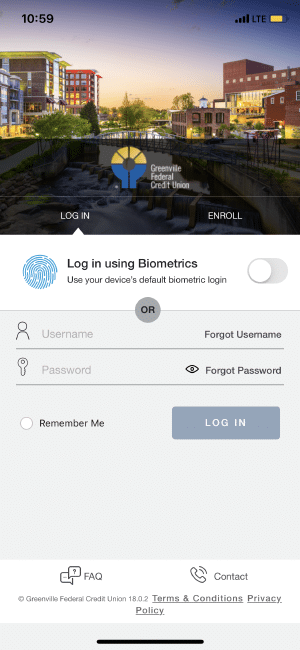

Enter your USERNAME and PASSWORD and tap LOGIN. Once you log in manually, biometrics can be enabled for future use.

Verification Stage – Enter last 4 digits of the primary cardholder’s social security number, card expiration date, and 3-digit security code.

Profile Info – Verify name, add a card nickname if desired, verify phone number and add email address.

You are now enrolled.

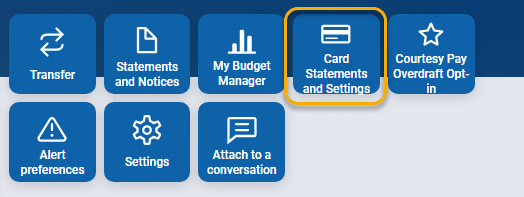

You can view and filter your card transactions, pay your credit card bill and view payments previously made, lock or unlock cards, activate cards, set travel notes, and set alerts & controls.

The latest version of iOS and Android are supported plus two previous versions.

As long as there is an internet connection, via either a mobile data plan or a Wi-Fi connection, the app will work.

You need to have the card number for one of the cards you want to manage using this app, information about the primary cardholder, and contact information that will be used to set up your profile.

Please return to the login page and tap on “Contact” to get the phone number you can call for additional assistance.

Your username should be between 6 and 16 characters with no special characters (ex. #, !, or &), cannot be your first or last name, and must be unique in our system. Your password should be at least 8 characters and must include a combination of uppercase and lowercase letters, numbers, and special characters. The email address you enter should include the @ sign, should be valid, and must also be unique in our system—only one user account can be tied to a given email address.

Please call the number provided. If you tried to log in to your account but failed to enter the correct username and password five or more times, then your account will be locked and will need to be unlocked before you can log into the app.

This message may sometimes indicate there is a wide-spread issue with the app. You can try to uninstall and re-install the app. You can also tap on “Contact” to reach a phone number that you can call for assistance or to report the issue.

If you forget your username, tap on “Forgot Username” and enter the email address associated with your profile. You then will be prompted to answer a security question. After you verify your identity, we will send your username to the email address you provided.

If you forget your password, tap on “Forgot Password” and enter your username and one of the card numbers that has been associated with your account. You then will be prompted to answer a security question. After you verify your identity, we will send a temporary password to the email address associated with your profile. The temporary password will expire after 1 hour.

Return to the login page, login with your username and temporary password, and then you will be prompted to enter your temporary password once again and to pick and verify a new password.

You can see transactions and payments related to the credit or debit card(s) you have added to your user profile. If you would like to add more card accounts to your user profile, you can swipe to pull up Add Card all the way to the right of the Account Summary.

Yes. If you have the card number and information about the primary cardholder, you can add the card at the time of enrollment or after enrollment by swiping to the far right in the Account Summary and then tap on Add Card.

Due to limits on the availability of particular information on checking or savings accounts, your account balance is not visible for your debit card(s) inside this app.

You can view credit card payments that are pending. Once a payment is scheduled, changes cannot be made to it, however the payment can be cancelled.

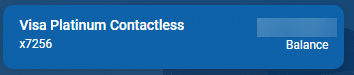

Your card’s nickname will appear on the Account Summary, Transactions, and other screens. Its purpose is to help you distinguish between different cards that have been added to your user profile.

By clicking “Accept all,” you agree Greenville Federal Credit Union can store cookies on your device and disclose information in accordance with our Cookie Policy.