What if you could see up-to-the-minute details of all of your financial accounts and activities in one place? Better yet, what if you could set financial goals that are specific, measurable, and achievable based on all of your account information? And, what if you could set a budget and track your progress in real time? Now you can.

The credit union is pleased to offer My Budget Manager, a free and secure personal budgeting tool within Online and Mobile Banking. My Budget Manager is an online Personal Financial Manager (PFM) that allows enrolled members to import online banking account information from inside or outside the credit union into their online banking profiles. With one-time setup, single sign-on and intuitive navigation, My Budget Manager makes monitoring cash flow, maintaining budgets and managing financial goals convenient and easy. And, unlike other online PFM tools, account information gathered within My Budget Manager is never shared with any outside institutions.

Build and view spending targets that are important to your financial big picture. The new insights feature provides your spending history, along with suggestions for staying on track.

By adding your paychecks and expenses, you’re now able to view income and spending trends right from the dashboard. The better you understand your cash flow, the easier it is to manage it on a daily, weekly, and monthly basis.

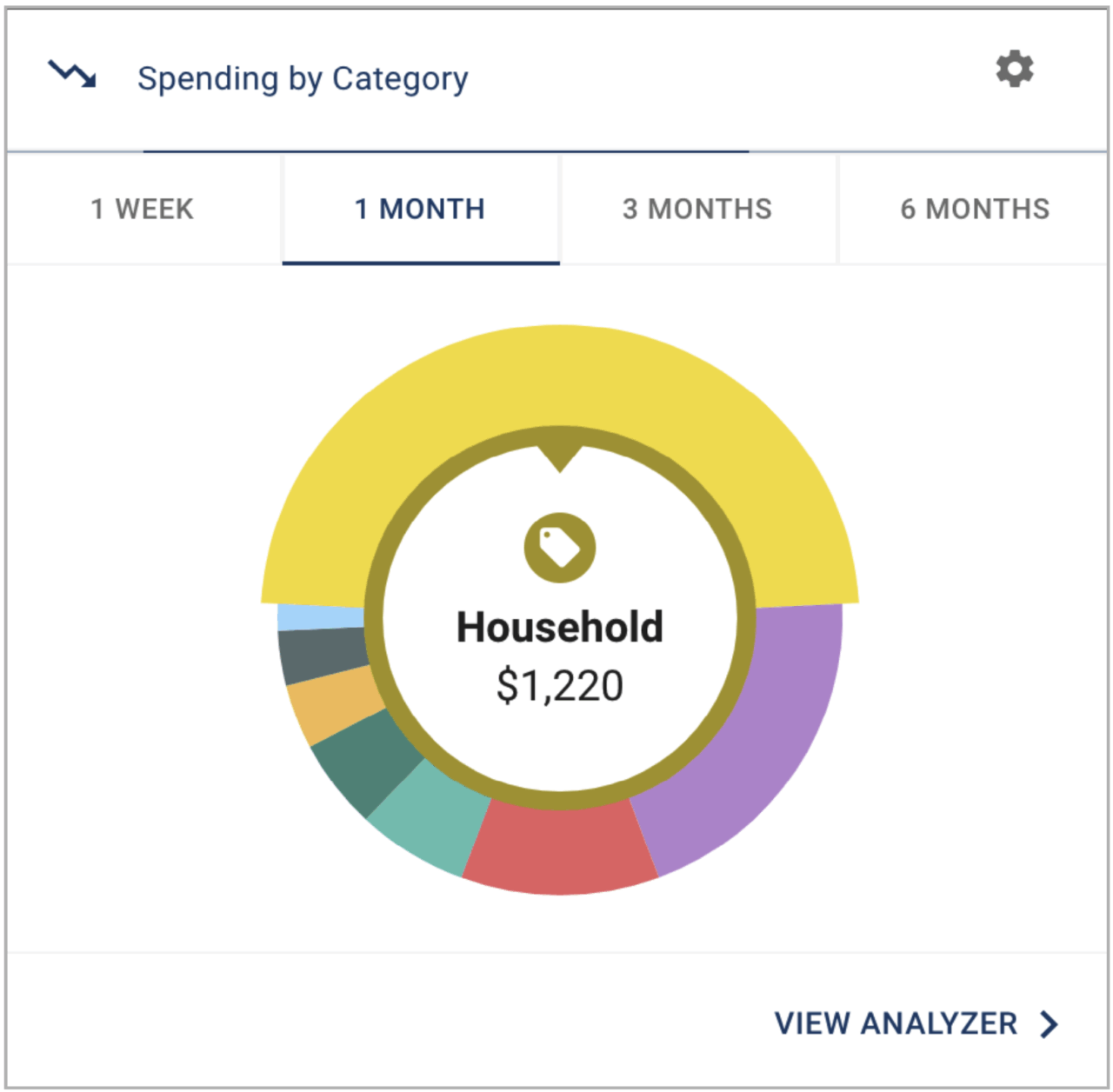

The analyzer quickly shows your percentage and total amount spent in each category, while allowing the user to customize the date range to identify any trends.

Track your investments, wealth, and debts all in one place, while having access to monthly, quarterly, and annual trends. Your financial future is just as important as your day-to-day.

See which spending category you have spent the most in so far this month.

Step 1: Select other parts of the wheel to see other major category spending. Your transactions will categorize themselves with ‘tags’.

Step 2: To personalize these categories, or split the transaction between tags, select the transaction and edit the tag.

Step 3: When you select a transaction from the dashboard you can also change the name of the transaction, create a budge or add a recurring transaction to your Cashflow Calendar.

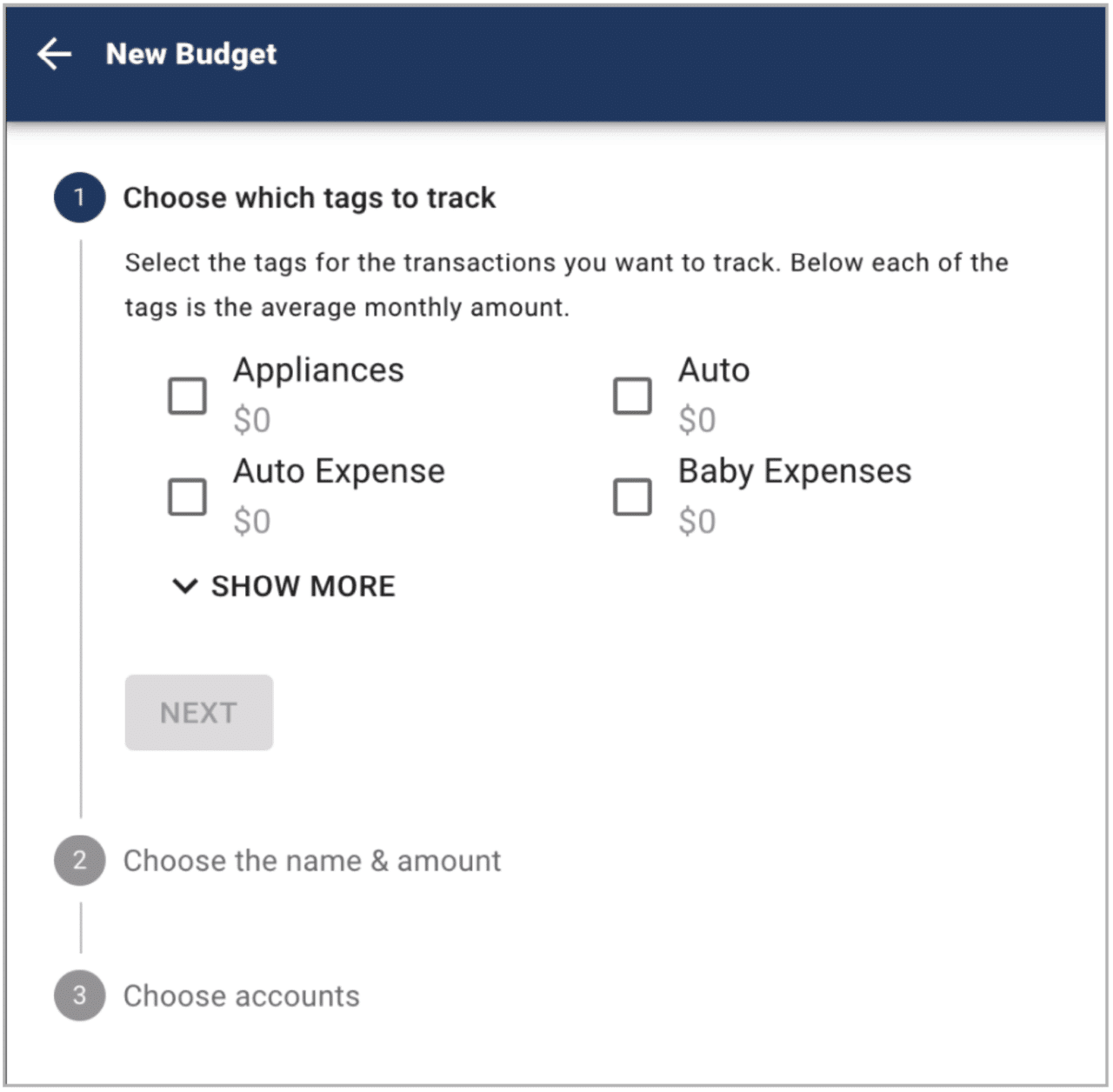

New users can look at the insights for guidance on what to budget based on spending.

Step 1: Navigate to Budgets and click on “View Budgets.”

Step 2: Click on the Spending Target you’d like to edit from the list.

Step 3: Click “Edit Budget” to edit or delete.

Step 4: You can change the name, amount, tags, and accounts associated with this Spending Target from here.

The cash flow calendar brings your budget to life

through an interactive calendar.

Step 1: Navigate to Cashflow.

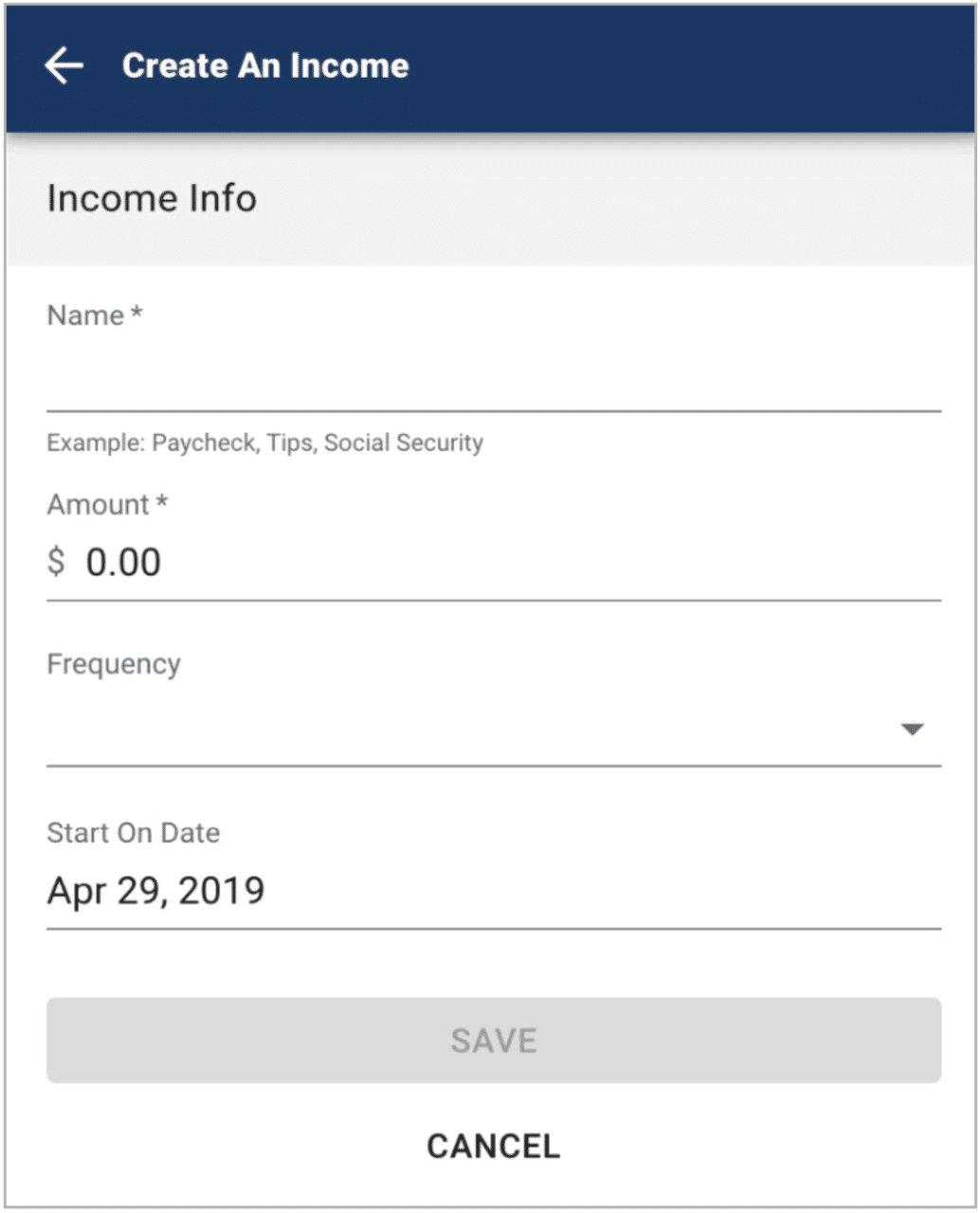

Step 2: Click the plus sign to “Add Income” or “Add Bill.”

Step 3: Enter in the required information and select “Save.”

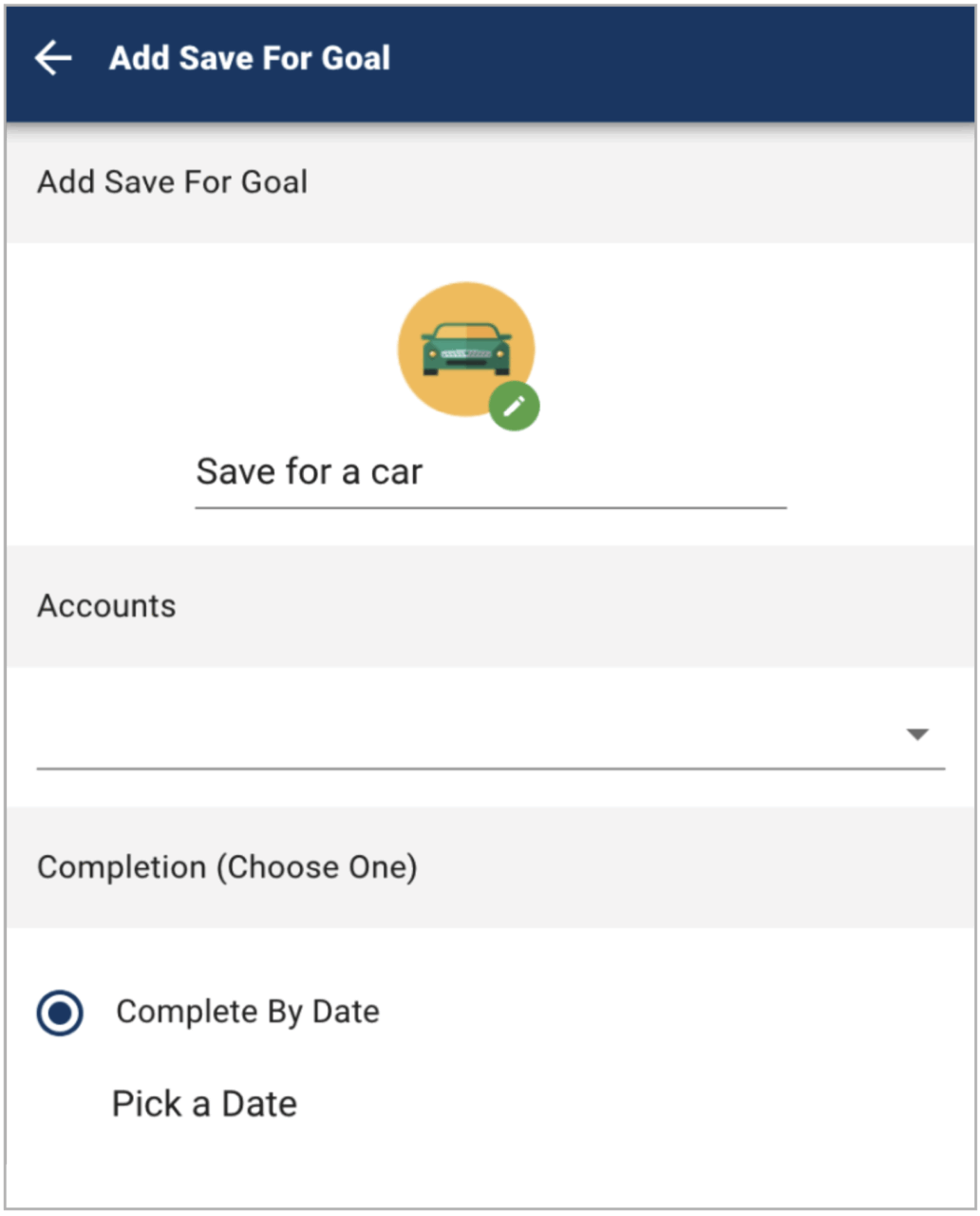

Create savings goals, like saving for a vacation, or a debt reduction goal, like paying off a high-rate credit card.

Step 1: Navigate to Goals, and select “Add Goal.”

Step 2: Select your desired pay off or savings goal.

Step 3: Fill in the required information.

Step 4: Click “Save” to complete the process of adding a new goal. Keep in mind, your Goal Summary will update your completion date and the amount needed per month according to your preferences. Goals will automatically update your progress and will reflect your day-to-day account balances in PFM.

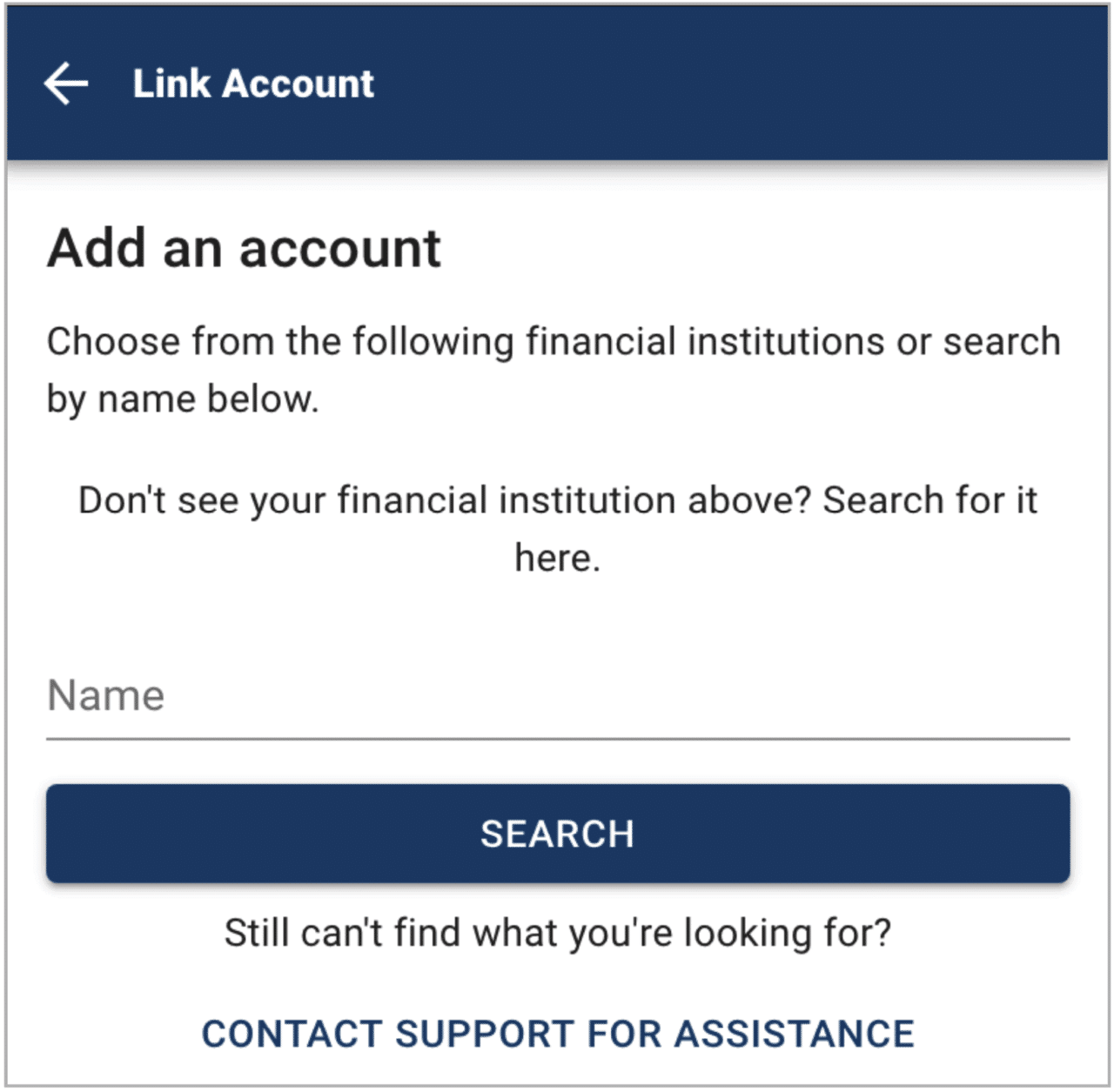

Syncing other accounts for a complete financial picture is simple.

Step 1: Navigate to Accounts, and click the plus sign to “Add Linked Account.”

Step 2: Select an institution or use the search to find your institution.

Step 3: Enter in the required information and select “Connect.”

You’ll receive a notification on your PFM dashboard once the account has been synced successfully.

My Budget Manager provides you the tools to help successfully manage and track your finances. You can create a budget, monitor expenses, and set goals. We’ll also allow you to track your upcoming bills and incomes, and enable you to view all your accounts in one convenient location. My Budget Manager can help you in tangible ways to improve your overall financial health.

If you have questions or issues with any of the above steps, reference the appropriate section of this FAQ. If you still can’t find an answer to your question, please contact the credit union.

You can view the following items on your Dashboard:

We currently support:

If you have an older browser, please try upgrading to one of these supported browsers. Also ensure that your security settings allow My Budget Manager to function properly. You may experience issues if your browser has cookies turned off, is operating with a high security level, or has additional add-ons installed. If you experience a problem with one of our supported browsers, please contact the credit union after verifying your browser settings.

We support more than 13,000 financial institutions of all sizes. If you’re having trouble finding yours, try these search tips:

For example: Try typing one word at a time if your institution has a long name. If your financial institution has an abbreviation, (i.e. SECU) try searching under those terms as well.

This is an indication of a problem connecting to your account. A blue symbol often indicates a temporary external site issue or expected maintenance. This error message should resolve after a few days. Please contact support if the issue persists. A red symbol is an indication of a login error. This can mean that your password needs to be updated, or you have security questions that need to be answered. Click the link provided in the error message to manually update your username and password. You may also be prompted with additional security questions. If your account still does not update, please contact the credit union.

Click the ‘ADD’ button in your left sidebar.

Enter your financial institution’s name into the search box. Check the URL associated with the institution to make sure it is where you normally access your account(s).

Enter your login information EXACTLY as you would when logging into your financial institution directly and click ‘CONNECT’.

Classify your account(s) by type.

If you receive an error message:

The name of the financial institution you are trying to add

The website (URL) used to access the account directly

Also leave the partially-added attempt on the Dashboard as this is necessary for troubleshooting.

You do have the ability to delete accounts that you have manually added to My Budget Manager. However, at this time you cannot remove accounts that come over automatically.

We cannot support your financial institution for account aggregation because they require an image-based, randomly-generated security code to be entered each time you sign in. We currently don’t have the infrastructure in place to support such a security process; however, we are working on this and hope to be able to support such accounts in the future.

Yes, you can remove transactions. These transactions will still be visible on your account directly, but will no longer show in My Budget Manager. Please note that this is a permanent action and cannot be undone.

Use ‘split tags’ to categorize your cash withdrawal transactions. You are unable to manually enter cash transactions, but using ‘split tags’ will allow you to break down a cash transaction into groceries, dining out, transportation, etc. Learn more about split tagging under ‘Tagging’. Learn more within our split tagging FAQ.

A tag is a customizable word or phrase used to categorize your transactions. This feature gives you a better idea of how you’re spending your money by tracking transactions in the same category. We will automatically pull in your most recent transactions and tag them (i.e. transportation, groceries, clothing). We suggest you edit your tags by clicking on the ‘EDIT’ button associated with each transaction. Customized tags give you a more accurate view of your budget(s), spending history and overall financial picture.

If you’d like to change a transaction’s title and/or edit the tag to be applied to similar transactions, check the box in the ‘Create a Rule’ area of the transaction editor. This will allow you to choose from a number of different recurrence styles:

Creating rules for certain transactions, such as a ‘Check’ transaction, is not advised. It will apply that title and tag to all other checks. Please contact support if you have additional questions regarding tagging rules.

Budgets use ‘Spending Targets’ to track variable expenses. Budgets always run from the first to the last day of each month. Spending Targets are automatically color-coded based on your spending progress.

Spending Targets are variable expenses (i.e. groceries, entertainment, or dining out). These can be linked to tags, which allow you to track your monthly expenditures.

Bills are recurring expenses (i.e. rent, loans, or insurance). These expenses generally have a due date. See the Cashflow section for more information.

You can set up Alerts in My Budget Manager to remind you of your upcoming bills! See the Cashflow section for more information on adding your bills.

If you are having issues with your budget, please check these common causes before contacting support:

Use Cashflow to get a quick glance of when your bills are due, when your paycheck is coming, and for viewing ‘safe to spend’ balances. Click ‘Cashflow’ to open the calendar and click on a day to add a new income source or bill due.

The Cashflow calendar is designed for planning and estimation purposes only. No real money is ever withdrawn from your account(s) in My Budget Manager. The Cashflow calendar simply uses your current daily balance and then takes into account all future income and bills that you’ve entered.

Cashflow is not meant for variable income, so in order to account for possible variances input your best guess ahead of time and edit once the exact value is known. The daily balance will automatically adjust to the actual income deposited into your account. Here are some tips:

Due to changes on Capital One 360’s website, we now use an access code to bring in your accounts rather than your regular PIN. To create an access code, please follow these instructions:

When creating a Goal you may choose to ‘lock’ a sum of money from being counted toward your goal. This provides an accurate reading of your current goal progress, as you may never want to leave less than the locked amount in your account. No real money is ever locked away from you by choosing this option.

Alerts are personalized notifications sent to your email and/or mobile device which help you keep track of your account activity. Be alerted of upcoming bills, monitor account balances to avoid fees, and review transactions of a certain amount or from a particular store.

Account Balance

Spending Target Exceeded

Goal Progress

Bill Reminder

Large Transaction

Specific Store Purchase

Choose the Alert Option(s):

Email

Text Message

All of your My Budget Manager alerts will appear on the Dashboard once they have been triggered.

Click ‘ADD ALERT’.

Please keep in mind that there is often a slight delay between triggering an alert and receiving it, as we have to wait until a transaction is posted to send a related alert.

We welcome questions and feedback! Please reach out here. Kindly provide as many details as possible, including the below information as applicable:

For account addition/update issues:

Be sure to also leave the partial add attempt on the Dashboard as this is necessary for troubleshooting.

By clicking “Accept all,” you agree Greenville Federal Credit Union can store cookies on your device and disclose information in accordance with our Cookie Policy.

Please enter your information below to access your download.