Paying off debt shouldn’t prevent you from saving for unexpected expenses.

Now there’s a loan that comes with a built-in solution. Greenville Federal Credit Union’s Take-Back Loan gives you the confidence to pay ahead on your balance knowing you can always tap into that extra cash if needed. That’s what we call a “Take-Back,” and that peace of mind could add up to some major savings for you. Whether you get an Auto Loan or a Personal Loan from Greenville Federal Credit Union you’ll have access to the same great perks.

Apply and agree to competitive loan terms

Pay extra to shorten loan

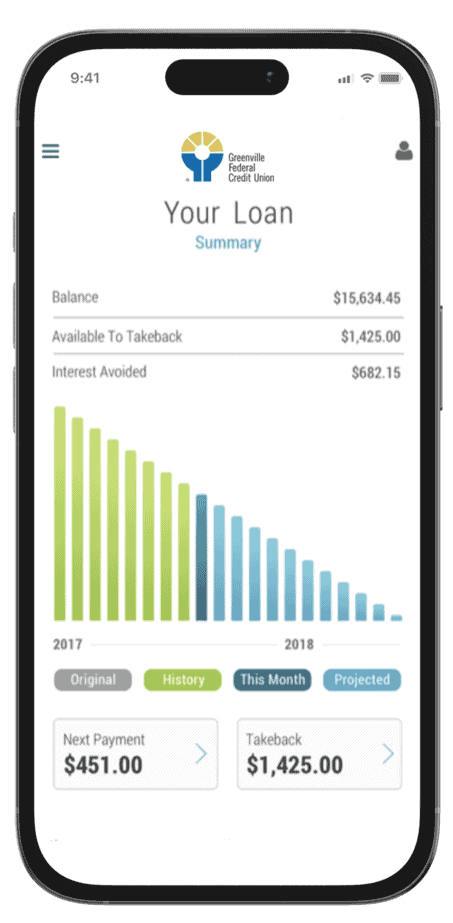

Full control at your fingertips with personal dashboard

Access to extra money you’ve paid

Take back extra money with no change in rate or terms

Keeping all this newfound control straight is easy thanks to the handy dashboard inside Online and Mobile Banking (starting February 3, 2025).

About Your Take-Back Loan®. Your loan enables you to borrow money and pay it back on a fixed schedule just like any other personal loan, but your loan also gives you the option to make “Additional Payments” to reduce the total amount of interest that you must pay. In addition, if during the term of your loan you find that you need additional funds, you can borrow back some or all the additional funds that were credited as Additional Payments.

Loan Term: The term of your Account begins on the date of this Agreement and will continue until the Maturity Date, or until you have a zero balance on your Account, whichever occurs first. All indebtedness under this Agreement, if not paid pursuant to the payment provisions below, will be due and payable at maturity. We may renew or extend the term of your Account.

Interest Charges, Annual Percentage Rate, and Fees Interest Accrual. Interest on your Initial Draw and subsequent Loan Advances will begin to accrue on the date posted to your Account. There is no “grace period” in which you can avoid paying interest on your Initial Draw and any Loan Advances.

Balance Computation Method: “Daily Balance.” We calculate the interest on your Account by applying the daily periodic rate to the Daily Balance of your Account. To get the Daily Balance, we take the beginning balance of your Account each day, add any Initial Draw, Loan Advances or other charges, and subtract any payments or credits made. This gives us the Daily Balance.

Amount of Interest Charges. Interest begins to accrue on the date of each advance and accrues for each day the balance remains unpaid. To compute accrued interest due, the unpaid Account balance for each day since your last payment (or since an advance if you have not yet made a payment) is multiplied by the daily periodic rate. The sum of these daily interest accruals becomes interest due on your Account.

Annual Percentage Rate. The Annual Percentage Rate corresponding to the Daily Periodic Rate is set forth in the Truth-in-Lending Disclosures, above (“PAYMENT TERMS OF YOUR TAKE BACK LOAN® OPEN-END CREDIT PLAN”). The Annual Percentage Rate may change as mutually agreed upon by you and Lender and as documented within a Subsequent Action form that will be incorporated into this Agreement upon execution. We will not charge any interest amount that would violate the interest rate we may charge under applicable federal or South Carolina state law.

Solely for the purposes of illustration, the following is a numeric example of how your Take Back Loan® can work: If on 12/31/2020 you borrow $5,000 on a thirty-six (36) month loan with an interest rate of 10% and covered with optional credit life and credit disability insurance, your first payment due date will be 1/31/2021, monthly payments will be $167.65, and total payments over the life of the loan will be $6,074.20 if all payments are made when due. Assuming you make your regular payments for one year (calculation: $167.65 x 12 = $2,011.80), then your credit limit at the end of that period will be the principal amount outstanding as outlined in the amortization schedule created for you at the time of Account opening: i.e. $3,538.46. Now, say you decided to make an Additional Payment of $500 on your Kasasa Loan® at any point during the life of the loan. This Additional Payment will create a “Take-Back Balance.” As long as you continue to make your regularly scheduled installment payments, you will be able to borrow (take back) all or some of the $500, when the need arises and subject to all terms and conditions in this Agreement. Borrowings made on your Take-Back Balance are called “Loan Advances.” The Take-Back Balance is calculated as the lesser of: 1. the scheduled principal balance outstanding for the period as outlined in the amortization schedule created for you minus the current principal balance outstanding; or 2. the total payments made through the period minus the expected installment payments as outlined in the amortization schedule Kasasa creates for you.

Daily Periodic Rate. To determine the Daily Periodic Rate that will apply to your Account, we divide the Annual Percentage Rate by 365. The result is the Daily Periodic Rate as set forth in the Truth-in-Lending Disclosure.

Application of Loan Payments: Payments will be applied to your loan in the following “waterfall” fashion:

Additional Information: Membership restrictions may apply. To qualify, a borrower must be at least 18 years old, a U.S. citizen or a permanent resident and must meet our institution’s underwriting requirements. Not all borrowers receive the lowest rate. To qualify for the lowest rate, you must have a responsible financial history and meet other funding criteria. If approved, your actual rate will be within the range of rates listed above and will depend on a variety of factors including the term of the loan, your financial history, years of experience, income and other factors. Rates and terms are subject to change at any time without notice and are subject to state restrictions. Contact one of our credit union loan representatives for additional information, details and loan application.

By clicking “Accept all,” you agree Greenville Federal Credit Union can store cookies on your device and disclose information in accordance with our Cookie Policy.

Please enter your information below to access your download.